We use cookies to improve Your browsing experience, deliver tailored content and ads, and analyze site traffic.

By selecting "Accept Cookies" You agree to the use of cookies as outlined in our Cookie Policy.

Explore the safest, fastest and most reliable crypto exchanges for every type of trader.

Compare the best platforms for beginners, active traders and long-term holders.

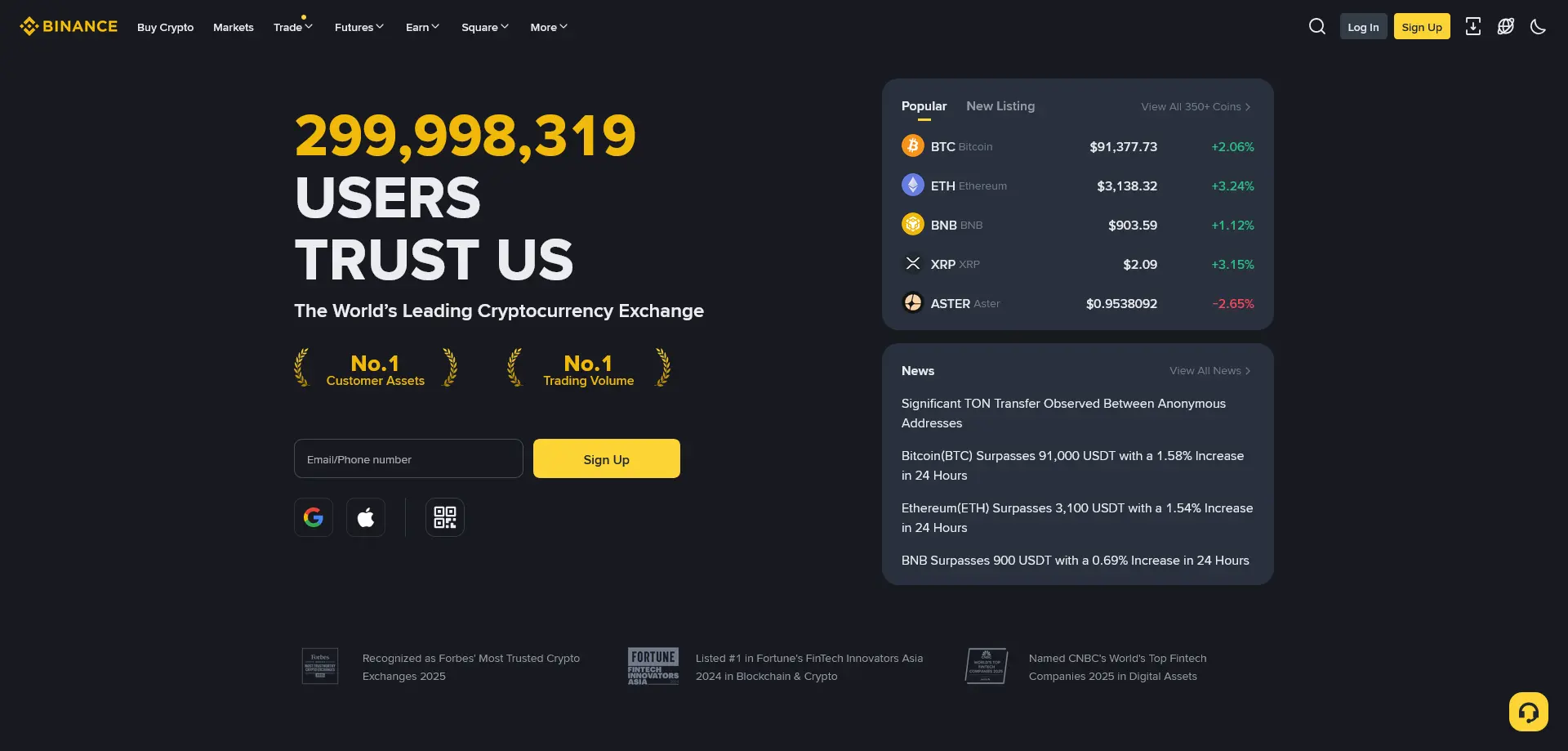

Binance is the world’s largest cryptocurrency exchange by trading volume, offering a massive selection of coins, advanced trading tools and competitive fees. It’s designed for both beginners and professionals, with features like spot, futures, staking and a highly liquid market.

One of the widest selections on the market — hundreds of cryptocurrencies and thousands of trading pairs, including rare altcoins and multiple fiat pairs.

Low fees, advanced trading tools, huge liquidity, staking/Earn products, P2P trading, futures, automated trading and rich analytics.

Multi-layer protection with 2FA, address whitelisting, anti-phishing codes, cold storage and the SAFU insurance fund for emergencies.

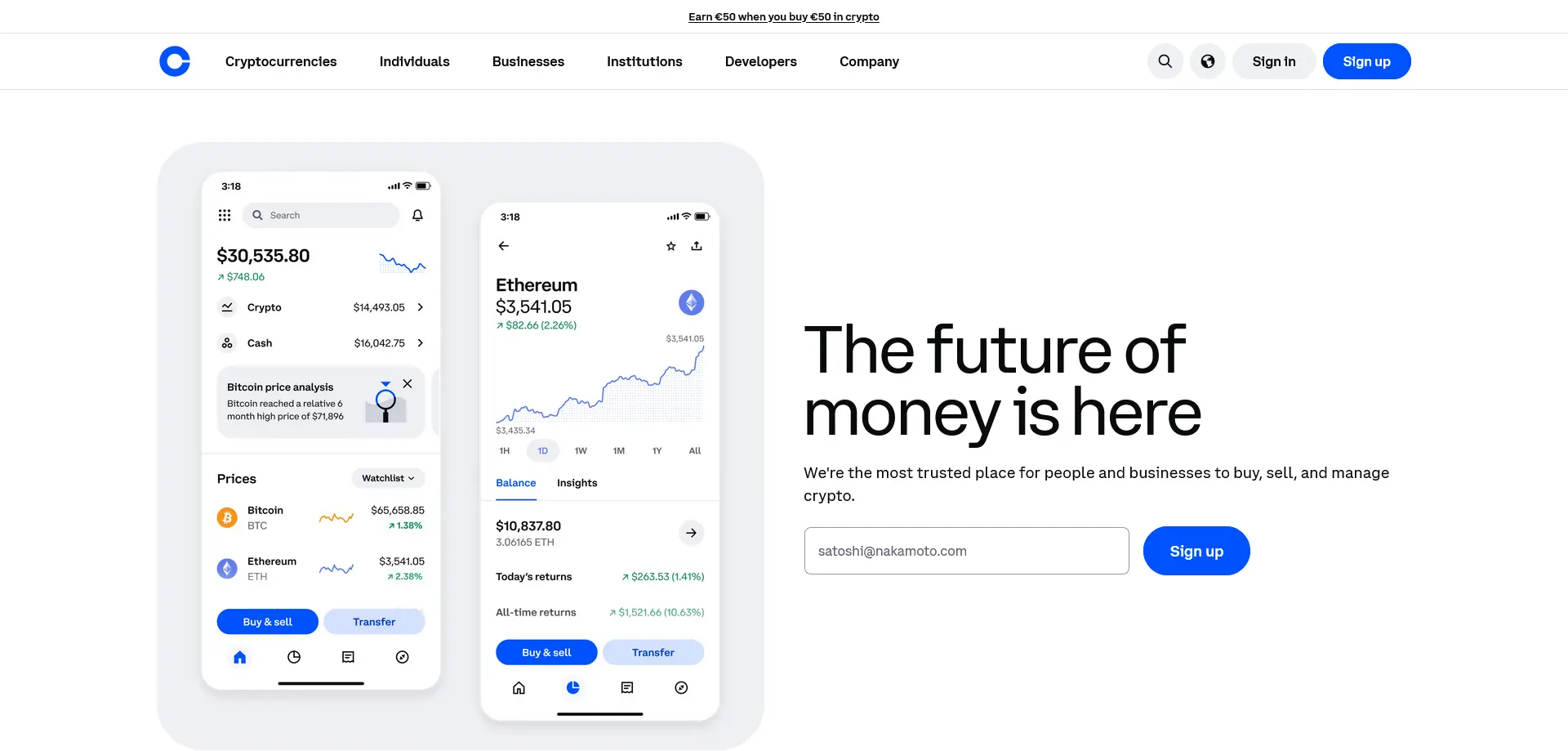

Coinbase is one of the most beginner-friendly crypto platforms, offering a clean interface, easy fiat on-ramping and tightly regulated infrastructure. It focuses on simplicity, making crypto buying and selling accessible while still providing a secure and trusted environment.

Offers several hundred cryptocurrencies, mostly well-vetted and beginner-friendly assets. Ideal for users who prefer a curated selection.

Very intuitive interface, fast fiat deposits, built-in wallet, educational rewards, one-click buying and access to Coinbase Advanced for pro trading.

Stores most assets offline, uses strict verification procedures, strong 2FA, biometric login options and multiple anti-fraud systems.

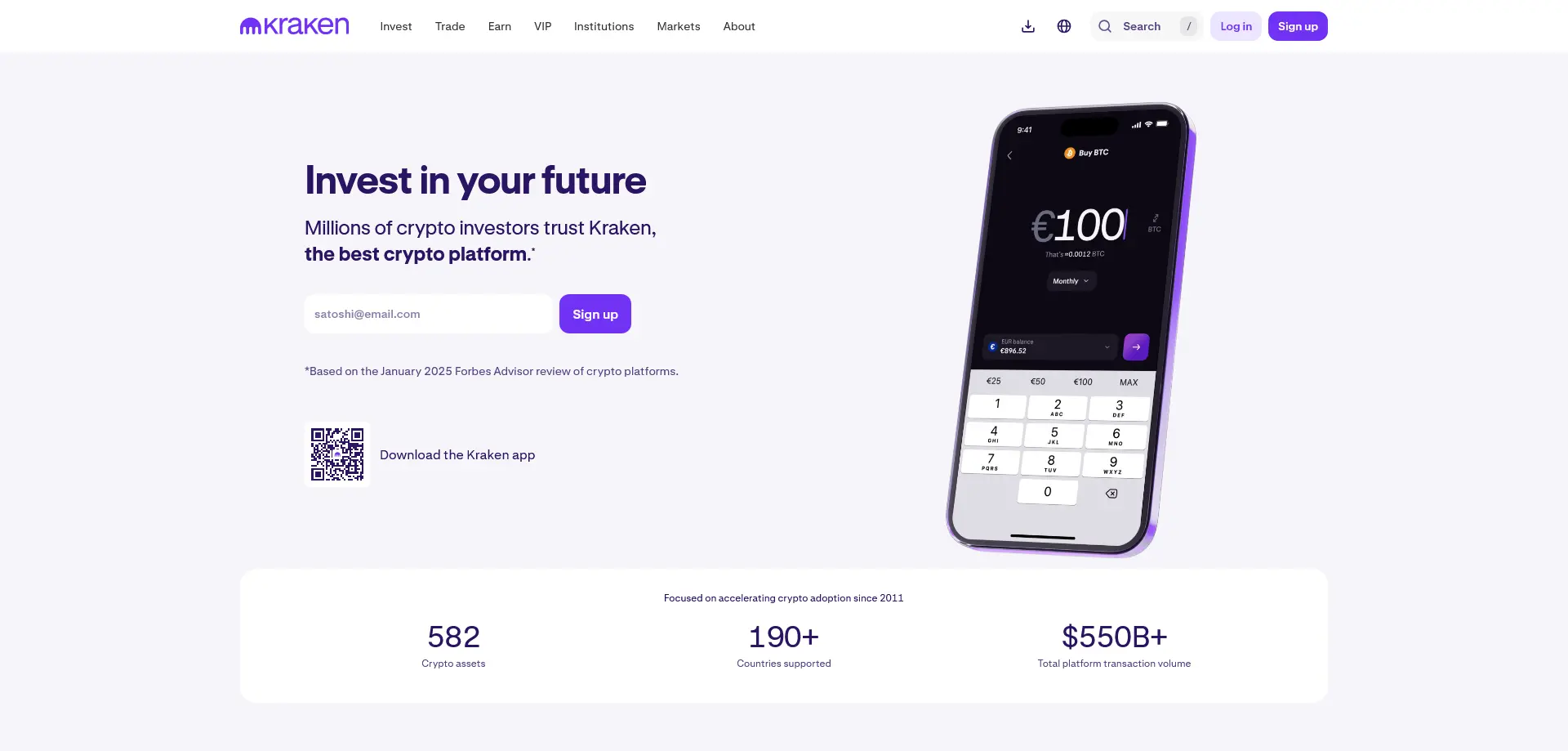

Kraken is a long-standing, security-focused exchange known for reliability and transparent operations. It offers a strong mix of major cryptocurrencies, low fees and advanced trading tools while maintaining one of the best reputations in the industry for safety and regulatory compliance.

Supports 200+ cryptocurrencies with a strong set of fiat pairs. Focuses on quality listings rather than sheer quantity.

Clean order management, advanced margin trading, on-chain staking, reliable mobile app and a long-standing reputation for stability and transparency.

Known for industry-leading security: majority cold storage, strong internal monitoring systems, strict operational standards and robust account protection tools.

A crypto exchange is an online platform where you can buy, sell and trade cryptocurrencies. Think of it as a digital marketplace: you come in with money and choose which coin you want to buy.

Exchanges offer different trading tools, such as market orders, which buy a coin at the current price, or limit orders, which allow you to set your own price and wait for the right moment.

An exchange provides liquidity, meaning you can quickly buy or sell cryptocurrency. However, it’s important to be aware of the risks: prices can fluctuate significantly and transaction fees can reduce your profits if you don’t account for them in advance.

The most common and beginner-friendly type. Operated by a company that manages the platform and temporarily holds user funds.

To learn more about CEX, please follow our guide about centralized exchanges.

Centralized exchanges offer a very beginner-friendly interface, high liquidity and fast order execution. They support fiat payments through cards and bank transfers, provide accessible customer support and include a wide range of trading tools.

The exchange controls your private keys, which means you depend on the platform for security. There is a risk of hacks or technical failures, KYC is usually required and users may face account freezes or regional restrictions.

Peer-to-peer trading platforms powered by smart contracts, without intermediaries and without custody of funds.

Read more about DEX in our guide about decentralized exchanges.

Decentralized exchanges let you keep full control of your private keys, operate without a central authority and usually do not require KYC. They provide access to early or rare tokens and offer more privacy compared to centralized exchanges.

They are more complex for beginners, often have lower liquidity on many trading pairs and require paying gas fees on certain blockchains. There is no customer support and users face a higher risk of interacting with scam or unverified tokens.

A newer model that combines the convenience of CEX with the self-custody aspects of DEX.

Want to get more about DEX, just follow our guide about hybrid exchanges.

Hybrid exchanges combine the convenience of centralized platforms with the self-custody benefits of decentralized systems. They often use safer custody models, offer a more transparent architecture and are ideal for users who want a balance between ease of use and strong security.

These platforms are still less popular and less battle-tested compared to CEX or DEX options. Liquidity pools are smaller, interfaces and features can differ greatly between providers and availability is limited in many regions.

Altcoins play a crucial role in the crypto ecosystem because they offer far more than just an alternative to Bitcoin. Many altcoins are designed to solve specific problems — from faster transactions and lower fees to enabling smart contracts, decentralized finance, gaming, or real-world asset tokenization. This variety gives traders access to different technologies, use cases and market opportunities that Bitcoin alone cannot provide.

For beginners, altcoins also create room for diversification. Instead of putting all funds into one asset, traders can spread their investments across multiple coins with different strengths, risk levels and growth potential. Many emerging altcoins provide early-stage opportunities that can deliver higher returns, although they also carry higher volatility and risk.

In short, altcoins matter because they expand the market, drive innovation and give traders more ways to grow their portfolios — whether through long-term investing, exploring new blockchain sectors, or taking advantage of short-term price movements.

Choosing the right crypto exchange is one of the most important decisions for any trader, especially beginners. Different platforms offer different strengths and understanding what matters will help you avoid unnecessary risks. The first factor is security — look for exchanges with strong track records, robust protection features and transparent operating policies. An exchange should make you feel confident that your funds are safe.

Another key factor is the selection of supported coins and trading pairs. Some exchanges focus on major assets like Bitcoin and Ethereum, while others offer hundreds of altcoins, giving you more opportunities to explore different parts of the market. Fees also play a major role: trading fees, withdrawal fees and deposit charges can add up quickly, so choosing a platform with fair pricing is essential.

You should also consider convenience and user experience. A good exchange should offer a clear interface, fast order execution, reliable mobile apps and easy onboarding for beginners. Finally, check the available payment methods, customer support quality, liquidity levels and whether the platform is accessible in your region. Taking these factors into account will help you choose an exchange that fits your goals, risk tolerance and trading style.

Trading altcoins effectively starts with understanding the unique behavior of each asset. Unlike Bitcoin, many altcoins move quickly, react strongly to news and can experience sharp price swings. Before entering any trade, take time to research the project behind the coin — its use case, team, technology and community support. This helps you avoid weak or speculative assets and focus on projects with real potential.

Risk management is essential when dealing with altcoins. Because they are more volatile, it’s smart to start with small position sizes and use stop-loss orders to protect your capital. Diversifying across several strong altcoins can also reduce risk, rather than putting all your funds into a single token. Timing matters too: watch trading volume, market sentiment and support/resistance levels to avoid buying during hype spikes or low-liquidity periods.

Finally, always consider your strategy. Some traders prefer short-term moves, taking advantage of rapid price changes, while others focus on long-term accumulation of promising projects. Whatever approach you choose, keep emotions out of trading, avoid chasing sudden pumps and review your trades regularly to learn from your results. With consistent research and disciplined risk control, altcoin trading becomes far safer and far more profitable.

Getting started with crypto is easier than it seems, but it’s important to follow a clear process so you can trade confidently and safely. The first step is creating an account on a trusted exchange.

Choose a platform that fits your needs, register and complete identity verification if the exchange requires KYC for fiat deposits or withdrawals. This ensures you’ll have full access to all features and payment methods.

Once your account is set up, the next step is adding funds. You can deposit money using a supported fiat currency—such as USD or EUR—or transfer cryptocurrency from an external wallet if you already own some.

Exchanges usually support multiple payment methods, so pick the one that’s most convenient and cost-efficient for you.

With funds ready, you can buy your first cryptocurrency. Beginners typically start with well-known coins like Bitcoin or Ethereum because they’re stable, highly liquid and widely supported.

Decide whether to place a market order for an instant purchase or a limit order if you prefer choosing your own price. This step helps you understand how the trading interface works.

After buying your crypto, it’s good practice to move your funds to a personal wallet, especially if you’re using a DEX or a hybrid exchange. While keeping coins on a centralized exchange is convenient, long-term security is stronger when you manage your own wallet.

Taking this extra step helps protect your investment and teaches you the fundamentals of self-custody from the beginning.

It’s best to start with a simple and trusted CEX that supports fiat currency and has a user-friendly interface. Before investing larger amounts, it’s important to understand the trading process: try trading $10–$50 first to practice and minimize risk.

Security should always be your top priority. Enable two-factor authentication, use cold wallets for storing larger amounts and be cautious with phishing websites. Also, pay attention to fees — withdrawal or trading fees can eat a significant part of a beginner’s profit.

Pick a trusted CEX with a solid reputation, user-friendly interface and fiat support.

Yes, most exchanges require verification to deposit or withdraw fiat currency.

$10–$50 is enough to understand the trading process without risking too much.

You can, but it is very risky for beginners. Start with spot trading first.

Check reputation, licenses and reviews. Avoid platforms with unrealistic promises or aggressive marketing.